Tekst Mészárosa R. Tamása jest owocem współpracy Krytyki Politycznej z niezależnymi redakcjami polskimi i węgierskimi, w ramach której przyglądamy się kwestiom istotnym z perspektywy obu krajów.

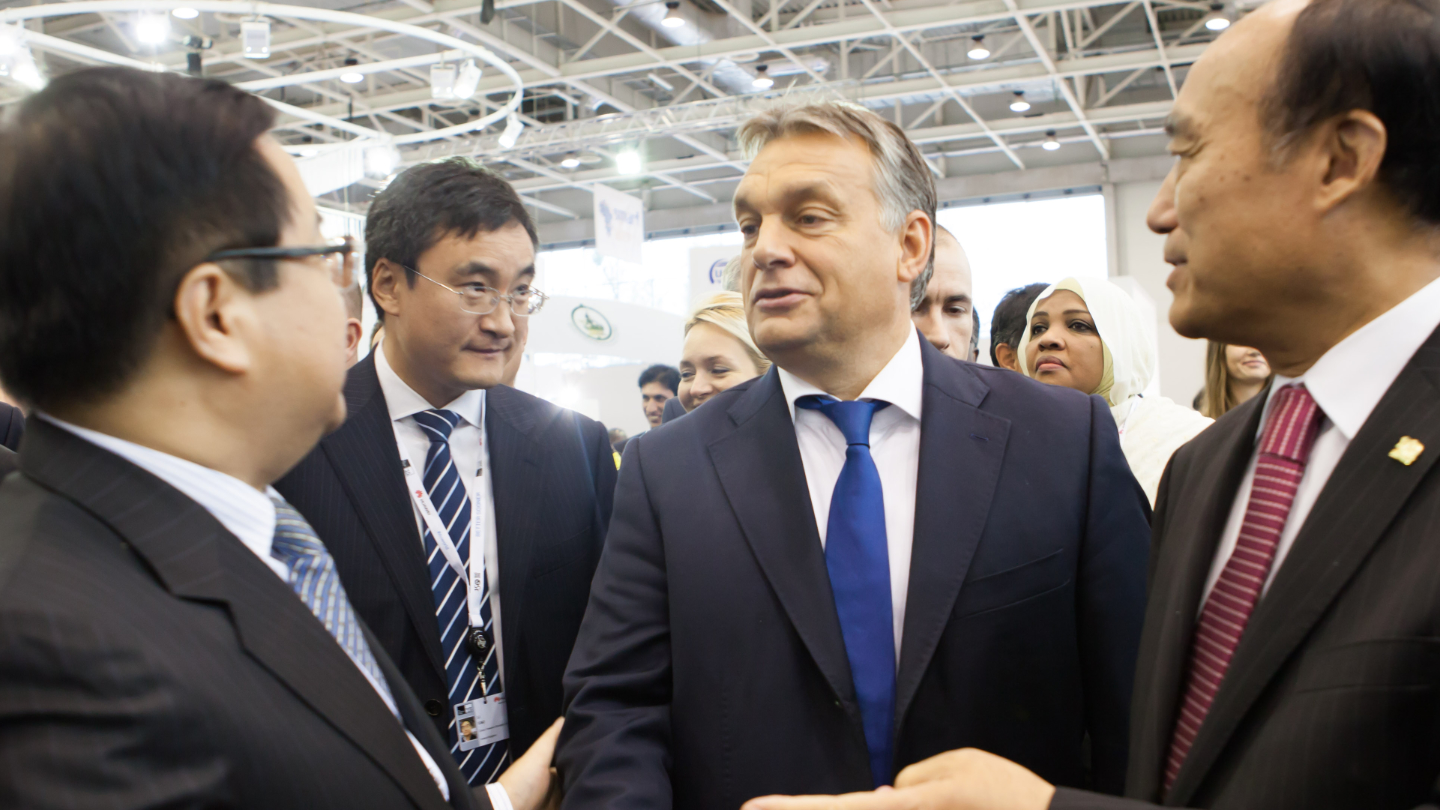

Balázs Orbán, dyrektor polityczny premiera, nazwał to polityką łączności, co oznacza, że Węgry mogą odnieść sukces, jeżeli staną się miejscem spotkań firm i technologii ze Wschodu i z Zachodu. Zaś Viktor Orbán określił niedawno swoją koncepcję mianem „neutralności gospodarczej”, zgodnie z którą Węgry mają trzymać się z dala od podziału światowej gospodarki na bloki i pozostaną otwarte na „wszystkie kierunki”.

Pierwsza część strategii, budowanie relacji ze Wschodem, wydaje się odnosić sukces.

Podczas gdy Komisja Europejska opowiada się za zmniejszaniem ryzyka gospodarczego ze strony Chin, a państwa bałtyckie i niektóre kraje regionu, od Rumunii po Czechy, zgodnie z interesami Zachodu coraz bardziej unikają bliskich relacji z Chinami, rząd węgierski w znaczący sposób wspiera finansowo i z radością przyjmuje chińskie inwestycje. Orbán wykonuje też spektakularne gesty w polityce zagranicznej, jak przeciwstawianie się nieprzychylnym Pekinowi wypowiedziom i działaniom UE, popieranie przez Węgry – jako jedyne państwo zachodnie – chińskiego „planu pokojowego” w Ukrainie czy angażowanie się w program Pasa i Szlaku.

Stosując tę taktykę, Węgry rzeczywiście stały się dzisiaj europejskim przyczółkiem dla chińskich firm. Według wspólnej oceny specjalistycznego ośrodka analiz rynkowych Rhodium China oraz „Financial Times” wobec napięć geopolitycznych i stosowanego protekcjonizmu Chiny w coraz większym stopniu zamiast bezpośrednich inwestycji starają się utrzymać i zwiększać swoją obecność na rynku zachodnim za pośrednictwem bardziej przyjaznych politycznie krajów trzecich. Od 2022 roku Węgry stały się jednym z najważniejszych krajów dystrybucji zagranicznej dla chińskich przedsiębiorstw, dzięki czemu w ubiegłym roku spośród wszystkich inwestycji chińskich zrealizowanych w UE prawie połowa przypadała na Węgry, a w branży samochodów elektrycznych udział Węgier wynosił ponad 60 proc.

Jednocześnie chińska gorączka inwestycyjna nie przyniosła dotychczas pobudzenia wzrostu węgierskiej gospodarki i wielu ekonomistów ma wątpliwości, czy kiedykolwiek do tego dojdzie.

Chińska ekspansja przez Meksyk, Irlandię, Serbię

W latach 2010–2019 chińskie firmy wydawały rocznie setki miliardów dolarów na wykupywanie zachodnich. W ostatnich latach natomiast, częściowo z powodu bardziej rygorystycznej w Chinach kontroli eksportu kapitału, a częściowo w wyniku działań protekcjonistycznych Zachodu, chińskie inwestycje w dużych i rozwiniętych państwach są coraz mniejsze.

W Stanach Zjednoczonych, a ostatnio również w państwach członkowskich Unii Europejskiej, wzrosła liczba postępowań pod kątem bezpieczeństwa narodowego, prowadzonych przeciwko chińskim inwestycjom i przejmowaniu firm, a podwyżki ceł i ochrona strategicznych sektorów, jak przemysł motoryzacyjny, mają przeciwdziałać ekspansji na rynki zachodnie wschodzących chińskich przedsiębiorstw. Dlatego coraz częściej chińskie firmy reorganizują swoje łańcuchy produkcyjne w kierunku przygranicznych regionów dużych rynków zachodnich.

Wykorzystując umowę o wolnym handlu między Stanami Zjednoczonymi a Meksykiem oraz stosunkowo niskie płace, Chińczycy, zamiast inwestować w USA, przenoszą końcowy montaż do Meksyku i Wietnamu. Ważną rolę w tej strategii odgrywa Singapur. Wiele chińskich firm poprzez centrum finansowe w Azji Południowo-Wschodniej próbuje uwolnić się od odium swojego pochodzenia i zapewnić sobie dostęp do rynków zachodnich oraz do jeszcze bardziej wrogiego wobec chińskiej ekspansji rynku indyjskiego. Najbardziej znanym przykładem jest chyba internetowy sklep odzieżowy Shein, który oficjalnie działa już dzisiaj jako firma singapurska i stara się wejść na giełdę, przy pewnej dezaprobacie władz Pekinu.

Przyczółkami Chin w Europie stały się Irlandia i Węgry. Irlandia z powodu luźnych przepisów podatkowych już wcześniej była popularnym europejskim przyczółkiem dla globalnego świata technologii, a w ostatnich latach obok amerykańskich pojawiły się tu również chińskie firmy technologiczne i oferujące usługi, od stojącej za TikTokiem ByteDance, przez Huawei, po firmy z branży biotechnologicznej i finansowej.

Dla porównania, Węgry – wskazują na to planowane inwestycje – stały się najważniejszym rynkiem zbytu dla chińskiego przemysłu samochodów elektrycznych. Jak wynika z danych Rhodium, w 2023 roku spośród wszystkich europejskich inwestycji chińskiego przemysłu samochodów elektrycznych aż 62 proc. skierowano na Węgry, co znacznie przewyższyło inwestycje w Niemczech, Francji czy Hiszpanii. Po tym, jak wartość wykupywanych zachodnich firm spadła do minimum, a większość całkowitych chińskich inwestycji kapitału obrotowego stanowił przemysł motoryzacyjny, Węgry z 44-procentowym udziałem w europejskich inwestycjach stały się w ubiegłym roku najchętniej wybieranym przez Chińczyków krajem docelowym UE.

Ważne, by zaznaczyć, że liczby podawane przez Rhodium nie wynikają z inwestycji już zrealizowanych, lecz z dzielenia oficjalnej kwoty zapowiedzianej inwestycji na planowane okresy jej realizacji. Z tego powodu np. dane węgierskie uwzględniają już fabrykę akumulatorów CATL w Debreczynie i planowaną montażownię samochodów BYD w Szeged, chociaż ten drugi projekt jest jeszcze w fazie początkowej, a budowa pierwszego dopiero się rozpoczęła. Sądząc po obecnej sytuacji w europejskim przemyśle motoryzacyjnym, nie ma żadnej pewności, czy te dwie inwestycje będą zrealizowane zgodnie z pierwotnym planem.

O podobną pozycję walczy Serbia. Znaczące chińskie inwestycje w tym kraju obejmują przemysł metalowy i stalowy, rozprzestrzeniają się w przemyśle wydobywczym i motoryzacyjnym oraz zwiększają swój udział w budownictwie infrastrukturalnym i nieruchomościach.

Czy to się opłaci?

Według kwietniowego raportu IMF wymienione kraje odgrywają coraz ważniejszą rolę w światowym systemie handlu jako pomosty pomiędzy blokami i przyczyniają się do wzmacniania relacji handlowych i inwestycyjnych. Handel płynący przez te państwa rośnie, co w krótkim czasie implikuje również wzrost produkcji.

Jednocześnie raport IMF wskazuje, że wprawdzie stosowanie łączników służy powstawaniu bezpośrednich relacji, ale nie przyczynia się ani do dywersyfikacji, ani wzmacniania łańcuchów dostaw, ani do spadku strategicznych zależności pomiędzy gospodarkami zachodnimi i Chinami. W kontekście Węgier oznacza to, że rola spinacza pomiędzy rynkami chińskim i europejskimi zarówno z punktu widzenia gospodarczego, jak i politycznego, niesie ze sobą ryzyka.

Na pierwsze wskazują już dzisiaj słabe wyniki przemysłu przetwórczego: z przyjęciem roli pośrednika rośnie zależność od popytu zachodniego i od wschodniego łańcucha dostaw, co w czasach cyklicznej słabości zewnętrznej sytuacji gospodarczej powoduje hamowanie wzrostu.

Drugi problem natury ekonomicznej polega na tym, że rola pośrednika generuje obroty w jednym kierunku. Chociaż Viktor Orbán twierdzi, że dzięki neutralności gospodarczej Węgry mogą uniezależnić się od słabych wyników Europy, w rzeczywistości w ostatnich latach prawie nie odnotowano wzrostu chińskiego eksportu, a rola pośrednika nie wystarczyła, aby Węgry podłączyły się do wykazującej nieco większy wzrost – choć aktualnie zmagającej się, podobnie jak Europa, z ospałością handlu – chińskiej gospodarki.

Trzeci problem wynika z tego, że rola pośrednika w praktyce oznacza zazwyczaj tworzenie zakładów montażowych o niskiej wartości dodanej, a nadzieje rządu na dostęp do chińskiej technologii okazują się płonne. W Wietnamie czy Meksyku może to wystarczyć do rozwoju, ale u nas, żeby wspiąć się na średni poziom rozwoju w UE – nie.

W dodatku strategia ta również z politycznego punktu widzenia może niepokoić. Meksyk już dziś odczuwa, że rola pośrednika wcale nie jest łatwa: rząd Stanów Zjednoczonych ogłosił, że nie będzie dłużej tolerował prób obchodzenia przez chińskie firmy amerykańskich ceł poprzez inwestycje w Meksyku. A możliwości, jakie daje rola pośrednika w branży samochodowej, znacznie ogranicza fakt, że we wrześniu Ministerstwo Handlu, powołując się na względy ochrony danych i bezpieczeństwa narodowego, wystąpiło z wnioskiem o całkowity zakaz importu samochodów posiadających oprogramowanie i komponenty elektroniczne pochodzenia chińskiego.

W Europie szanse na taki krok są dużo mniejsze, ale to, co dzieje się w Ameryce, pokazuje, że lawirowanie pomiędzy interesami geopolitycznymi wielkich graczy przez państwa o roli pośredników będzie możliwe jedynie na krótką metę.

**

Mészáros R. Tamás – węgierski badacz i dziennikarz specjalizujący się w polityce międzynarodowej i ekonomii. Głównym obszarem jego zainteresowań jest Azja Wschodnia.

Tłumaczenie: Anna Boros | Voxeurop

Wspieraj

Wspieraj

Wspieraj

Wspieraj  Wydawnictwo

Wydawnictwo

Zaloguj się

Zaloguj się